FAQ - Tax Invoices from Amazon and eBay with Droopify

Receiving tax invoices from Amazon without a Business account

It is possible to receive tax invoices even without an Amazon Business account.

Droopify simplifies this process: you can add your VAT number directly to your standard Amazon account and automatically receive electronic invoices on your SDI.

Note:

If Amazon does not automatically send the invoice, Droopify will request it from the seller using a pre-set message that includes your tax information.

How to add a tax code or VAT number to a non-Business Amazon account

- Log in to your Amazon account.

- Go to My Account.

- In the Orders and purchase preferences panel, click on Manage VAT information.

- Add your tax code or VAT number by following the steps provided by Amazon.

Once the procedure is completed, wait for Amazon to approve the request.

From that moment, for every purchase you will receive electronic invoices directly to your SDI.

If Amazon does not send the invoice, Droopify will automatically request the document from the seller using a pre-set message with your tax information.

Managing invoices on eBay through Droopify

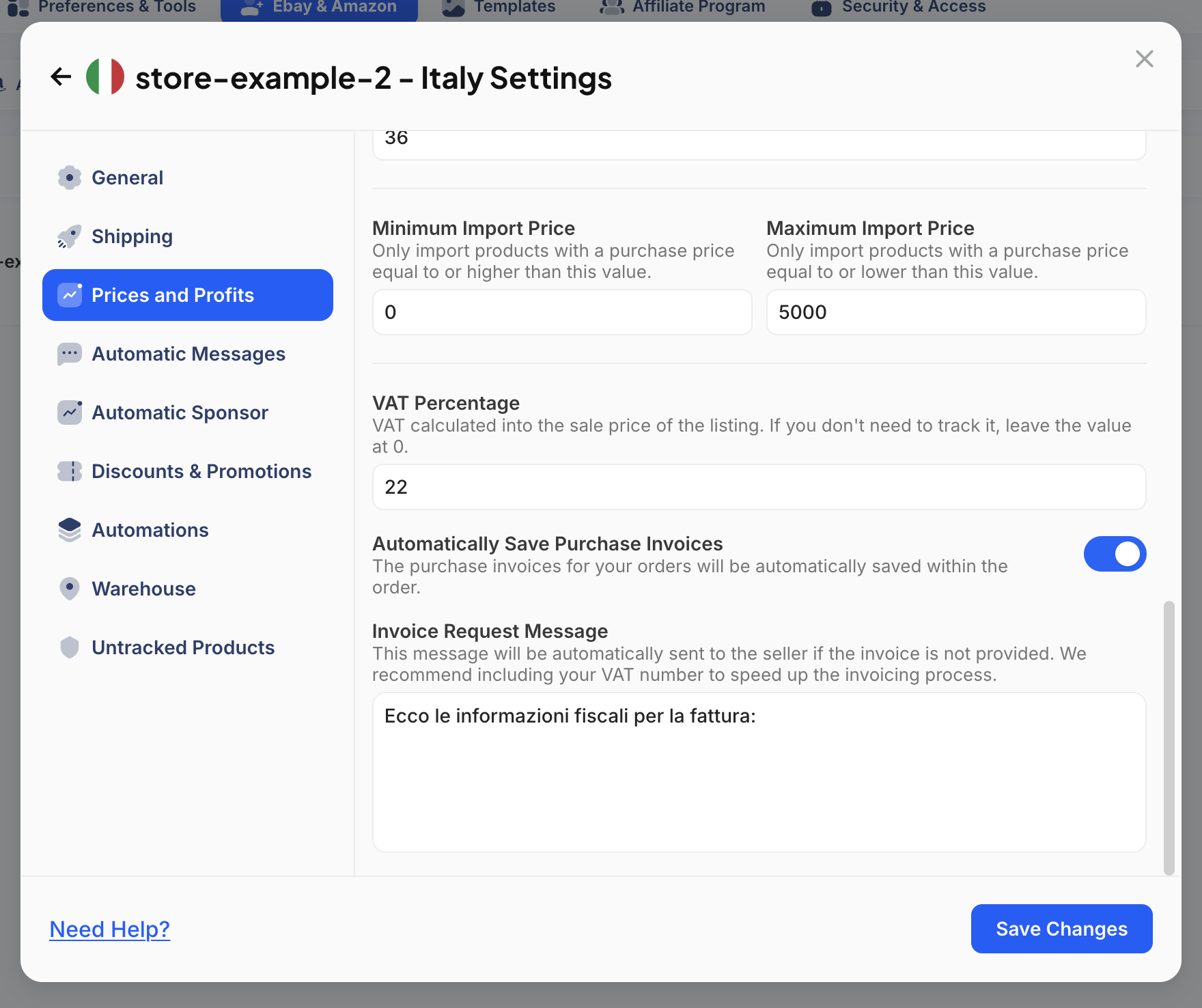

Within your eBay account settings, in the Settings -> eBay & Amazon section, you will find the Prices and Profits option.

At the bottom of this section, there are two key options:

| Option | Description |

|---|---|

| Automatically Save Purchase Invoices | During order monitoring, Droopify automatically searches for and attaches the supplier's invoice to the order, saving it in the cloud. This feature is useful for sellers with a VAT number. |

| Invoice Request Message | Available only if the previous option is enabled. Allows you to send an automatic message to suppliers when the invoice is not provided directly. |

To use this feature, enable both settings and set up an automatic message containing your tax information.

An example of a message could be the following:

Here are the tax details for the invoice:

Company Name: COMPANY LTD

VAT Number: IT0000000000001

PEC: pec@pec.pec

Unique Code / SDI: SUUUMM

Address 1: VIA ROMA 1

City: Rome

Postal Code: 00000

Province: RM

```